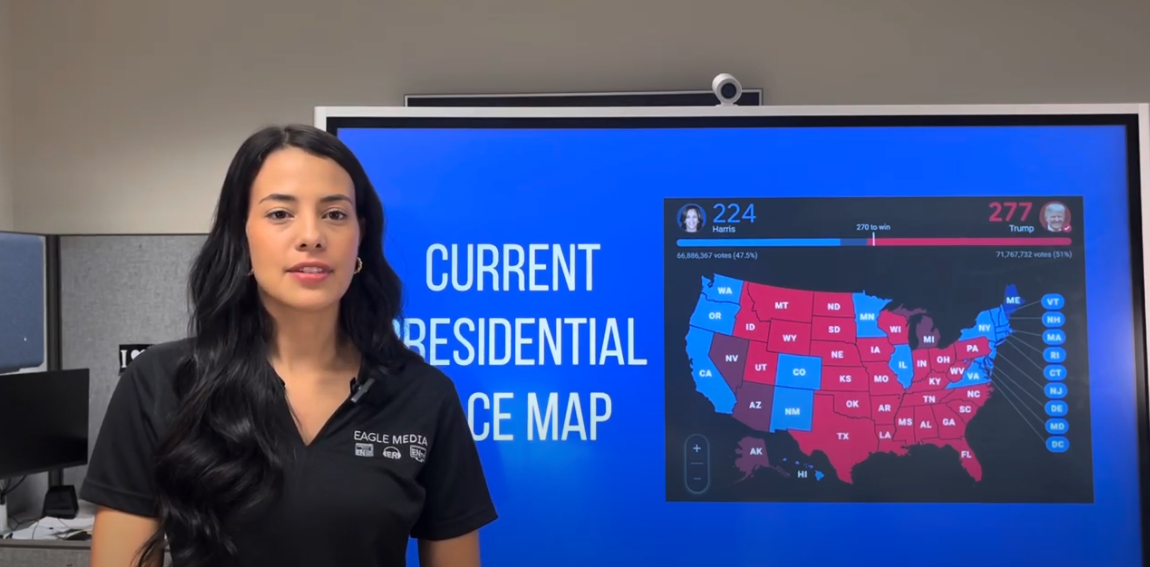

Currently, the economy is the top issue for voters in the 2024 election signifying its importance to voters. Many worry that Kamala Harris’ late entry into the ballot could signal a loss in the information race, but are her policies better for the economy than Donald Trump’s?

In late June, sixteen Nobel prize-winning economists signed an open letter, which warned of Trump’s economic plan. The economists claimed that President Joe Biden’s economic plans were “vastly superior” to that of Trump’s according to DocumentCloud.

Now, just a few days shy of the election, 23 Nobel prize-winning economists signed an open letter expressing their support of Harris’ economic policies. They agree that many of Trump’s policies, such as high tariffs and tax cuts for the rich, will lead to higher prices, larger deficits and greater inequality.

Nobel prizes are no easy feat to come by as only one is awarded within each recognized academic field annually. The aforementioned letter came along with another letter of endorsement signed by over 80 Nobel prize winners across many disciplines in favor of Harris.

Though Trump and Harris both promise to improve social security benefits for retirees. It is Trump’s plan that will actually negatively impact social security. His plan to deport millions of undocumented immigrants would negatively affect Social Security as it would rid the economy of undocumented immigrants who pay into Social Security while not being able to qualify for such benefits according to Marketplace. The presence of undocumented immigrants may benefit older, retired Americans, a fact the Trump campaign ignores in favor of hysterics.

Mass deportation is simply not the answer to addressing the spiraling cost of living. The labor of immigrants is incredibly vital to the U.S. Industries such as hospitality, construction and agriculture commonly employ undocumented immigrants. The consequences of mass deportation and Florida’s rising population would compound and the effects would be felt across the entire state, jeopardizing the state economy.

Likewise, Trump’s tariff plan to curb imports, which have exceeded exports in recent years, would only raise costs for the average American. According to PBS, Trump wants a 60% tariff on goods from China and 20% on every other import. Economists largely see tariffs as inefficient, raising prices for American consumers, slowing economic growth, and worsening inflation. Trump’s policies would lower the GDP and increase unemployment.

Trump also has no plan to address the drying up of Social Security in the mid-2030s while Republicans in the House attempt to raise the retirement age and cut Social Security. Meanwhile, Harris is exploring plans to raise the current tax cap for Social Security.

For instance, Harris plans to expand the child tax credit, currently $2,000 per child, to be permanently increased to $3,600 or $3,000 per child, depending on the child’s age, under Harris. Similarly, Harris would expand the earned income tax credit, favorably for workers without children, and lower the eligible age to 19 years. Harris wants to provide a $25,000 credit for first-time home buyers to be able to purchase a new home. Harris proposes to raise the corporate income tax rate to 28% from 21%.

According to the Wharton School, Trump’s alma mater, Harris’ economic policies would increase tax benefits for low and middle-income households. This is because her plans would increase incomes for the bottom 95% while the top 5% would see decreases. Those who bear the greatest costs are the top 1% and 0.1%. It is time that the richest pay their fair share in taxes.

It is clear, that in the 2024 presidential election, Harris must be the president to lead our economy into a better shape. Trump’s regressive policies will benefit the richest of our society and in turn place blame on our most vulnerable populations in the U.S.