Going to college is one of the biggest decisions a teenager is faced with. Not only the decision of whether or not to go, but how to pay for it.

The federal government has made it easy to figure out the financial part. Simply apply through a somewhat long process with the FAFSA, but once you’re done, you’re pretty much guaranteed money.

In 2013-2014, 85 percent of first-time, full-time undergraduate students at 4-year colleges, had federal student loans, according to the National Center for Education Statistics. With the majority of students in debt from school, is it proving to be worth it?

It sounds like good news – that people are easily able to obtain funds for their education – except that when they go to take out these loans, they often don’t take into consideration how much they are going to have to pay monthly and for how long after they graduate.

Student loans yield a monthly payment similar to a car loan or a mortgage on a house, but the process of getting the loan is completely different. For a car loan or a mortgage, you are required to provide copious amounts of paperwork and signatures, whereas for school loans, being a student with no guarantee of a job upon graduation, let alone in your field, is enough.

Alyson Brumbaugh, 26, graduated from FGCU with her master’s degree in clinical mental health counseling this summer. She earned her bachelor’s degree from Bowling Green State University in Ohio and after two years in the field, decided she wanted her master’s.

She used federal loans for all four years of her undergraduate education, which were costing her $189 each month. When she decided to go back for her master’s, she was able to defer payment on her existing loans while she was in school again and incurring more debt with loans paying for the new program, too.

“How much more could it hurt?” Brumbaugh said. “It hurts a lot more.”

Now, her combined student loan repayment costs almost $800 per month.

Luckily, within three months of graduation, she has been able to find a job in her field making enough money to comfortably pay her loans back on top of regular living expenses. But while she searched for jobs, she worked part-time at the Gap and when she received the first bill saying it was time to start paying loans back, it hit her that she had to find a better job fast.

Brumbaugh is in the minority – based on data from the latest U.S. Census in 2010 and a study done by Jaison Abel and Richard Dietz of the Federal Reserve Bank of New York, only 27 percent of college graduates were working a job that was related to their major.

This means that 73 percent of college graduates were working in jobs unrelated to what they had spent at least four years going to school for, and likely had tens of thousands of dollars of debt from.

Kara Cardinal, 32, from Malvern, Pennsylvania, falls into that 73 percent. She graduated from West Chester University of Pennsylvania in 2008 with her bachelor’s degree in elementary education with a minor in psychology.

Cardinal had made good connections in Pennsylvania and was able to find a job working with autistic children, but not long after graduating, she and her husband decided to move to Florida, where her career in education promptly ended.

“I applied to every public and private school in Lee and Collier county and couldn’t find a good-paying job,” Cardinal said. “I ended up finding something part time with no benefits. That’s when I knew I was in trouble and that if I didn’t find something outside of teaching, I wouldn’t be able to pay my loans back”

Cardinal has $40,000 in federal student loans. According to the National Student Loan Data System, the average student debt when Cardinal graduated in 2008 was $19,298. Over the past eight years, that number has steadily increased to $29,901.

“It was devastating to realize I couldn’t follow my dream because I couldn’t make enough here [in Florida],” Cardinal said.

John Arico, 31, from Watertown, Massachusetts, graduated from Bentley University in 2012 with his bachelor’s degree in finance.

He, however, does not carry any student loans. He attended MassBay Community College to get his associate’s degree and took advantage of his employer’s tuition reimbursement program to cover the majority of those costs.

When it came time to choose the next school for his bachelor’s, his choices were between one of the UMass state colleges or Bentley University, a private institution where his Mom worked and he had the opportunity to attend only having to pay fees – tuition was free.

Arico acknowledges that he was fortunate to not have to take out tens of thousands of dollars of student loans. Without having to worry about that expense, he was able to job search and be selective about where he worked – within his chosen field. And now, he has the luxury to save money for the future, instead of having to pay loans back.

“I started going for a management degree, but it was too vague,” Arico said. “I chose finance because I knew it wouldn’t be as hard to get employed. I think a lot of opportunities available to someone are dependent on the major they choose.”

Although he got lucky, he feels like there are a lot of things wrong with the way the higher education system works in the U.S.

“For one, the cost of college is too high,” Arico said. “If it costs more to produce an engineer, and that engineer is far more likely to find a job that pays more upon graduating, why is a liberal arts major paying the same price per credit? Why is that liberal arts student subsidizing the engineer?”

Tiara Brown, 24, from Florida, graduated from FGCU in 2014 with her bachelor’s degrees in journalism and communication. She has just over $34,000 in student loans. She’s supposed to pay close to $400 per month, but due to some circumstances, has been able to defer and qualify for government help.

The amount she pays now is basically only covering interest – so the actual loan amount is not going down at all.

“It sucks to know that you’re essentially spending decades paying for a bunch of stuff you never used,” Brown said. “But as much as I don’t like it, I benefited from the system too. The cost of the gym and medical health is rolled into tuition and there are plenty of students who don’t use those, but I did. It made my quality of life better.”

The Wall Street Journal reported that 43 percent of the 22 million Americans with federal student loans are not paying them.

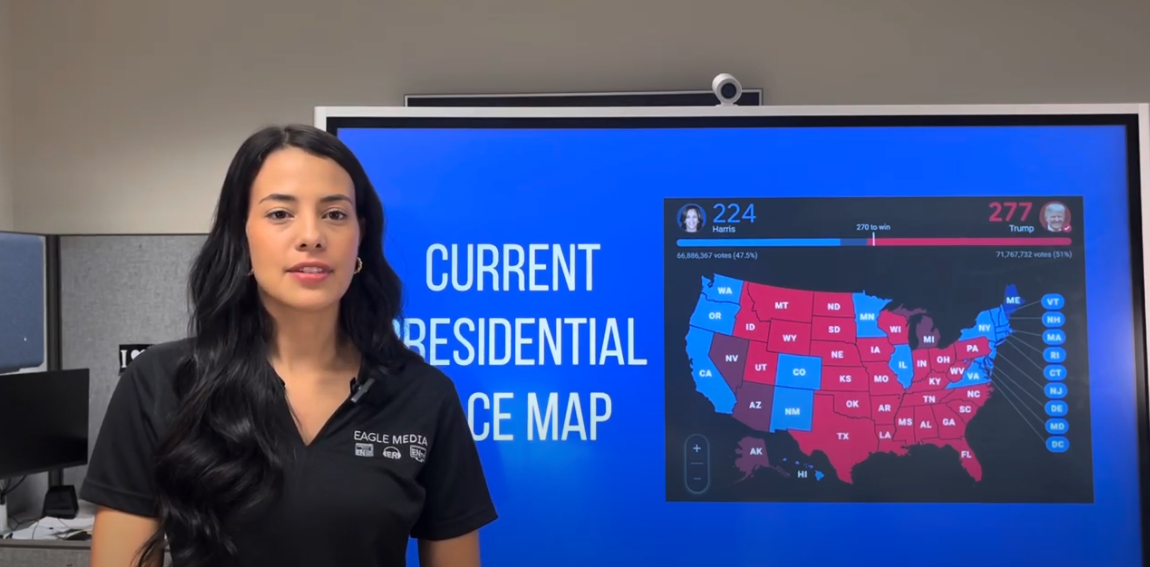

The results of this presidential election will play a role in what kind of change we see in how the higher education and loan systems work.